What is the Impact of AI on Cryptocurrency Trading?

- Posted by 3.0 University

- Categories Cryptocurrency

- Date March 25, 2025

- Comments 0 comment

Current progress in artificial intelligence and cryptocurrency trading merits a rigorous assessment.

At present, traders are relying exceedingly on AI-powered tools that instantly sift through vast streams of data, identifying trends and predicting price movements almost instantly.

Here’s an incisive not on AI Crypto Trading.

You can see this shift in the eye-catching display of AI in crypto trading (as illustrated in the image below), which really drives home how digital finance is evolving alongside our tech.

This mix speeds up the trading process and stirs up debates about whether markets are staying fair and whether relying on automated systems might be ethically slippery.

This piece shall let us know How to use AI for Crypto Trading.

In most cases, if you’re an investor or a regulator, getting a grip on what AI means in this realm is pretty crucial for understanding how our digital economy might shape up in the future.

Overview of AI and its relevance to cryptocurrency trading

Let’s discover illustrious realm of AI for Cryptocurrency Trading.

The Artificial intelligence and digital currency trading are merging in ways that shake up finance.

Traders now rely on smart algorithms to sift through giant volumes of market data in real time—picking up hints and patterns that most people would easily miss.

This approach not only speeds up transactions but, in most cases, also improves how accurately markets are forecasted.

For example, several trading platforms now come equipped with tools that predict market moves, a feature many traders use to take advantage of sudden price swings in cryptocurrencies.

An illustration in the image captures this mix pretty well; it shows a microprocessor paired with a trading smartphone, hinting at the tech that underpins these modern strategies.

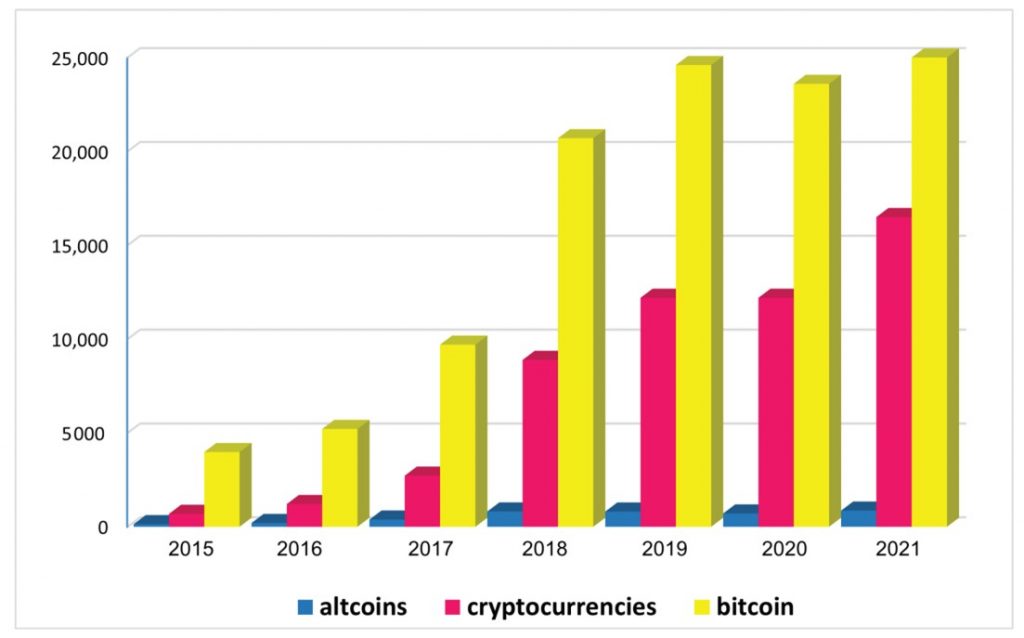

With cryptocurrencies growing so rapidly, the need for these advanced, AI-based trading methods is becoming increasingly clear—generally speaking, this trend underscores just how deeply AI is reshaping market dynamics.

Image1. Growth of Cryptocurrencies from 2015 to 2021

The Role of AI in Enhancing Trading Strategies

AI has completely transformed the crypto trading landscape. Traders now lean on smart, AI-powered algorithms that wade through enormous amounts of data—picking up on trends and quirks a human might easily skip over.

In general, machine learning models are highly effective in forecasting; a study demonstrates that these models achieve high accuracy and outperform older techniques such as autoregressive integrated moving averages or the exponential moving average in predicting cryptocurrency prices and returns.

This enhancement not only strengthens trading strategies but also reduces risks, enhancing decision-making to a more informed level—and who wouldn’t desire that?

Besides, what’s more pertinent is how strategically reinforcement learning is maneuvering into the spotlight – further, extending efficacious solutions for complicated issues like real-time risk management and fine-tuning portfolios.

Traders are facilitated with a new dimension to navigate the volatile fluctuations of the cryptocurrency market with increased confidence and precision by this pioneering consolidation of AI in trading, which embodies a substantial change, largely. a new perspective to navigate the volatile.

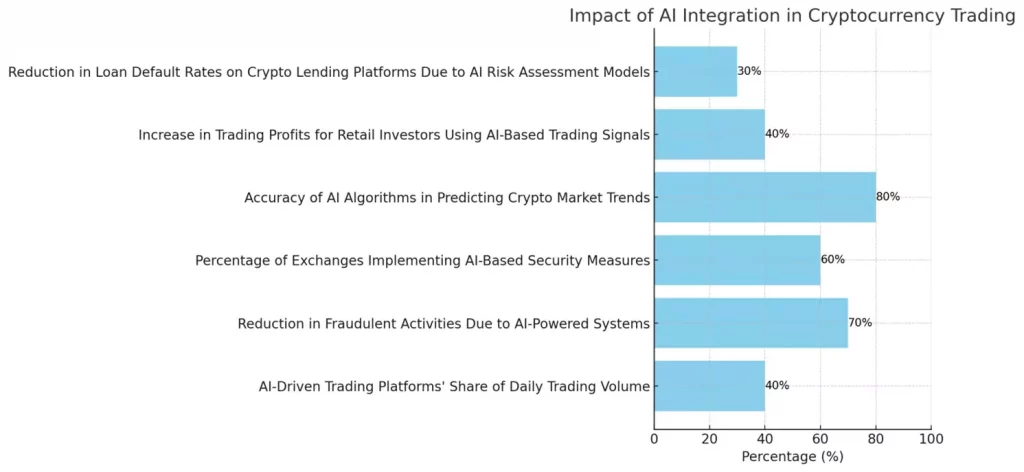

This horizontal bar chart illustrates the impact of AI integration in cryptocurrency trading by displaying various metrics, such as the share of daily trading volume, reduction in fraudulent activities, implementation of AI-based security measures, accuracy of market predictions, trading profits, and reduction in loan default rates.

Each bar represents a percentage value, highlighting the significant improvements enabled by AI technologies in this sector.

Machine learning algorithms and their effectiveness in predicting market trends

Machine learning has become a notable force in cryptocurrency trading. Instead of leaning only on human judgment, these systems dig into massive datasets, often catching subtle patterns that might otherwise slip by unnoticed.

Generally speaking, they refine their models with real-time data, helping traders better understand the crypto market’s wild swings. It’s interesting to see AI and traditional insights blend, as illustrated in the image, which signals a broader, if somewhat unpredictable, shift in how trades are managed.

Their knack for predicting price moves eases the design of investment strategies, even as it raises questions about market fairness and possible manipulation.

As cryptocurrencies steadily gain ground, machine learning’s growing role hints at a future where investment frameworks and strategic approaches in the digital currency space are fundamentally rewritten.

Study | Focus | Methods | Metrics | Results |

Liu et al. (2021) | Bitcoin prices | SDAE, BPNN, SVR | MAPE, RMSE, DA | SDAE: MAPE 4.5%, RMSE 0.012 |

Jaquart et al. (2022) | Crypto trading | LSTM, GRU | Accuracy, Sharpe ratio | Accuracy: 57.5%-59.5%, SR: 3.23 (LSTM) |

Saad et al. (2019) | Crypto dynamics | Economic theories, ML methods | Accuracy | Up to 99% accuracy |

Akyildirim et al. (2021) | Crypto prices | SVM, Logistic Regression, ANN, RF | Accuracy | Accuracy: 55%-65% |

Hafid et al. (2023) | Bitcoin trends | RF, technical indicators | Accuracy | 86% accuracy |

Roy et al. (2023) | Bitcoin prices | LSTM | MAE, RMSE, R² | MAE: 253.30, RMSE: 409.41, R²: 0.9987 |

Comparison of Machine Learning Models in Cryptocurrency Price Prediction

The Risks and Challenges of AI in Cryptocurrency Trading

Although the advantage of usage of artificial intelligence in cryptocurrency trading may seemingly surface as an innovative option, it involves numerous risks that cannot be overlooked.

The volatility of the crypto market, characterized by abrupt price jumps triggered by shifting attitudes and approaches or moods or unexpected news, makes it a highly unstable or unpredictable conditions.

Even if these AI systems boast impressive number-crunching skills, they can get lost in all the chaos.

Crypto prices don’t follow a neat pattern; they jump around unpredictably, often driven by the very market sentiment and news that rattles the system.

When split-second, detailed decisions are required, this unpredictable “noise” truly challenges even the most sophisticated models. At the same time, over-relying on algorithms can make traders overly confident, leaning on automated signals instead of trusting their judgment.

A quick glance at the graph showing AI’s role in trading hints at both potential gains and hidden perils—a shaky dance between tech advances and a market that just won’t sit still.

Ultimately, these points underscore that although intelligent technology can provide a competitive advantage, its limitations become evident when making immediate and nuanced decisions.

Potential for market manipulation and ethical concerns surrounding AI usage

Artificial intelligence coming into crypto trading is stirring up some serious ethical puzzles, especially when it comes to market manipulation.

High-speed trading bots—ones that execute trades almost in the blink of an eye—now pop up everywhere, and with them, shady moves like pump-and-dump schemes can start showing up.

Traders who use these tools have a way of shoving market prices in unexpected tracks or routes, frequently establishing unconventional spin around that can easily mislead less experienced investors.

Additionally, many of these purported proprietary algorithms operate surreptitious or in concealment, compelling it to be extremely challenging to discern the reasons behind market fluctuations.

Candidly, this absence of transparency weakens and undermines investor confidence or faith and exacerbates the already volatile state of the crypto market.

In a sense, the combination of advanced AI and crypto trading demonstrates that these sophisticated tools, despite their impressive capabilities, can inadvertently lead to manipulation, thereby igniting a crucial discussion about ethical considerations.

As we dive deeper into an era where AI drives more of our trading, it becomes, generally speaking, crucial to build ethical guidelines that protect market fairness while still giving room for innovation.

Conclusion

Artificial intelligence has significantly transformed cryptocurrency trading, bringing about unexpected changes in our financial landscape that blend innovative ideas with a significant degree of complexity.

As these AI systems keep getting smarter, traders now enjoy a kind of supercharged insight that helps them deal with the wild ups and downs of digital currencies.

It’s also interesting how more folks—newbies along with the old pros—can now jump into trading thanks to these accessible AI tools, which kind of even out the playing field.

This spreading of smart tools tends to stir up market dynamics in ways that mirror just how fast the crypto world shifts. When you see AI woven into trading platforms, represented by , it clearly shows how tech and finance are now in a kind of constant dialogue, with AI sharpening strategies and boosting predictions.

All in all, while AI opens up some pretty exciting doors, it also means traders need to get a solid handle on its twists and turns to navigate this transformed market with both caution and a bit of guts.

Summary of AI’s dual impact on cryptocurrency trading and future implications

Artificial intelligence is rapidly reshaping cryptocurrency trading and mixing excitement with a bit of apprehension about future outcomes.

AI is not merely just a catch phrase or a buzzword here—it strengthens or empowers smart algorithms that quickly crunch market data, forecast price moves, and even run trades automatically; often, this means better profit chances for those in the know.

However, it’s important to note that these advanced tools can also increase volatility and facilitate market manipulation, as AI-powered bots can react almost instantly, sometimes intensifying price swings.

Traders now find themselves having to really get into how these systems tick, which—generally speaking—leads to a more hands-on, strategic approach to investing.

A figure in the text shows this mix, casually highlighting how AI partners with trading platforms streamline decision-making.

All in all, embracing AI in cryptocurrency trading is definitely shaking up traditional practices, but it also introduces challenges that require thoughtful and careful navigation in our constantly evolving financial scene.

You may also like

Blockchain and Crypto Education Boom in India

Best Institutions for Blockchain and Crypto Jobs